Revolutionize

your Contact Center with Human-Voice AI

Elevate your customer service experience with AI that speaks in a realistic human voice, offering an unparalleled level of comfort and familiarity. Hear for yourself by listening to these real call samples.

Call count:

ProtoCall AI®

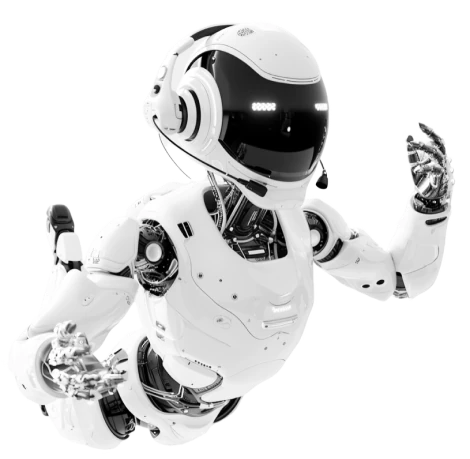

Experience the next level of customer service with our human-sounding AI for contact centers. Our AI speaks with the warmth and clarity of a human voice, engaging customers in a more personal and reassuring way.

We’re not just another AI. We’re a partner in enhancing customer satisfaction and loyalty.

Features for the Real World

★Voice Replacement

Human voice records script in any voice or dialect.

Six Sigma optimizes script, voice & outcome.

Message entities merge in the flow of a base message.

Eliminates variance in agent voice attributes.

Dialog Design

Includes Process Builder, a sophisticated, intuitive application to build call flows.

Drives best practices specific to a conversation including compliance and quality.

Based on customer-utterance mapping, delivers the correct response and brings the conversation back on track.

Eliminates unwanted variance in conversations.

Data Integration

Multi-sourced, pre-thru-post call data is captured including 'real-time speech' and 'intent matching'.

Machine learning collects and processes data to optimize results.

Drives difficult conversational decisions and eliminates unwanted variance.

Delivers measurable conversations and outcomes.

ProtoCall AI® improves predictions, insights,and interactions with customers by usinga large dataset of real conversations.

Solutions for Autonomous Cx

Methods, approaches and technology change, but some aspects of customer behavior are here to stay.

The portion of online customer interactions that leads to a phone conversation

Customers who prefer to make purchases by phone, such as Insurance, Healthcare and Telecom

Low-value calls that burden your Contact Center

Source: Invoca 2021 Ovum Research

How ProtoCall AI® Works in Real Life

Consumers speak differently when talking to an automated system versus a human being, significantly impacting conversational flow

Distribution of interviewees' answers to a simple question:

Do you own your home?

Talking with ProtoCall AI®

Talking with ProtoCall AI® Response to Automation

Response to AutomationEfficiency of IMPLEMENTING ProtoCall AI®

Before

Before YoY with ProtoCall AI®

YoY with ProtoCall AI®

Source: 2021 Aberdeen Strategy Research

SLM Powered, LLM Enhanced: Our Hybrid Approach to AI

(SLM — Small Language Models, LLM — Large Language Models)

Response Time

SLM Faster

LLM Slower

Small Language Models

Provide swift, efficient responses, making them ideal for dynamic environments where speed and agility are paramount.

Large Language Models

May encounter latency problems, particularly when deployed remotely, due to their large size and the computational power needed to generate responses.

Performance & Accuracy

SLM Specialized

LLM Broad

Small Language Models

Engineered for precision, excel in delivering accurate results tailored to specialized tasks, ensuring high-performance outcomes with less data.

Large Language Models

Often need lots of computing power, usually in the cloud. Even with possible internet delays, this lets us use smarter and bigger models.

Model Size & Scalability

SLM Compact

LLM Expansive

Small Language Models

Offer a perfect balance of size and functionality, ensuring seamless scalability and integration in various environments without heavy resource demands.

Large Language Models

Provide broad language understanding and handle diverse queries accurately, crucial for nuanced contexts. Yet, they might lack precision in domain-specific tasks due to their generalized nature.

Privacy & Security

SLM Private

LLM Shared

Small Language Models

Local processing translates to superior privacy and security, keeping sensitive data in-house and under tight control.

Large Language Models

When deployed on cloud servers, there might be concerns about data privacy and security, especially in scenarios involving sensitive information.

Customization & Control

SLM Targeted

LLM Universal

Small Language Models

Experience bespoke performance, where models are finely tuned to your specific requirements, offering unmatched control and customization.

Large Language Models

While highly versatile, they might not always align perfectly with specific domain needs without additional fine-tuning or prompting strategies.

Adaptability & Learning

SLM Specific

LLM Flexible

Small Language Models

Quick to learn and easy to update, these are the go-to for evolving with task-specific demands, ensuring your solutions remain cutting-edge.

Large Language Models

Highly adaptable to new data types, offering updated responses without frequent retraining. Leveraging extensive pre-training on diverse datasets, they understand and generate responses to novel queries effectively.

With decades of experience in contact centeroptimization, KomBea is a close observer ofglobal trends. This is what makes ProtoCall AI®great.

Company

Founded in 2001, incorporated in 2003, and headquartered in the heart of Silicon Slopes, KomBea develops contact center technology to enhance and perfect agent-customer phone interactions. Contact center agents around the globe use KomBea technology on millions of calls each week.

Learn more about KomBea

Word of Mouth

Book a Demo

Take the first step to raising

your contact center to the next level